The business of monitoring, measuring and understanding social media

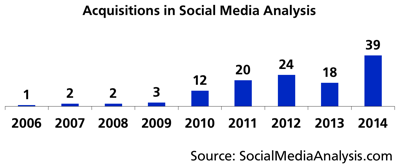

The Year in M&A, Social Media Analysis 2014

2014 saw 39 companies in social media analysis change hands, a big jump from the 18 in 2013. Continuing an ongoing trend, most of the year's deals involved strategic technology acquisitions or specialist firms joining bigger companies, often to add social media analysis capabilities to a vertically or functionally specialized software portfolio. In addition to a long list of smaller combinations, we also saw two distinct types of big moves in 2014: companies making multiple acquisitions to position themselves as major players and large companies filling out their portfolios with specialist capabilities.

Here's a recap of the year's deals. As always, you can find the latest deals and a record of past deals in the space at SMA's acquisitions scorecard.

Bold Positions

One way to build a major player is to buy the necessary pieces. The private-equity fund GTCR bought and combined Cision and Vocus to form the new Cision, then added Gorkana and Visible Technologies in a bid to create a one-stop software supplier for PR. Sprinklr bought Dachis Group (analytics & consulting), TBG Digital (paid social) and Branderati (influencer/advocate marketing). Hootsuite built out its software portfolio with uberVu (social media analysis), Brightkit (campaign management) and Zeetl (integration with telephone-based customer support).

Big Buyer Initiative

Twitter changed the landscape of the data market with its purchase of Gnip, and it extended its moves toward linking social media to television viewing with Mesagraph and SecondSync. Dun & Bradstreet took the social data matching business from Fliptop, which refocused on a lead-scoring application. LexisNexis took all of Moreover to incorporate into the next generation of its information platform. Microsoft bought Parature to add customer self-service to its Dynamics CRM.

A data intelligence company (Verint) bought a customer-service software company (KANA) that had bought a text analytics developer with a social media analysis product. This is why I'm flexible about the boundaries of the space and who I pay attention to.

Portfolio Builders

Linkfluence bought TrendyBuzz to consolidate its position in France and got a monitoring platform, too. Also in France, Akio added social media to its multichannel customer engagement suite with Spotter and expanded its geographic reach in the bargain.

Influence sells, or at least technology to measure model it does. Lithium Technologies took Klout, and Brandwatch picked up PeerIndex.

Innodata bought MediaMiser as a complement to its product line (and picked up the assets of the shuttered Bulldog Reporter before the holidays). Lexalytics rolled up Semantria, which had developed low-price tools on Lexalytics technology, to address smaller companies.

Confirmit took Integrasco to add social media to a feedback and engagement management portfolio. Mu Sigma added to its decision sciences portfolio with Webfluenz, and SeaChange got social for its television- and video-industry customers with Timeline Labs.

Socialbakers got content analysis with Social Insider and Facebook analytics with Applum. Unified got activity analytics for its social media management platform with awe.sm. Fluid added social media to its digital shopping portfolio with 8thBridge, and Genesys picked up Solariat for increased social media capability in contact centers.

Teaming Up

Some of the year's deals were more merger than acquisition. Evolve24 and Sherpa Analytics, two companies with a common founder, joined and keep the Evolve24 name. Spredfast and Mass Relevance became Spredfast. Polygraph Media and Offergraph joined to explore new uses for social media data. OhMyGov and Infoition merged to form Synoptos.

Buying Staff and Customers

Poptip joined Palantir in what looks like an acquihire. blueReport bought mostly market share with net-clipping. Engagement Labs added to its services team with Entrinsic. In the professional services market, Brillio picked up 100 people for its analytics practice with Marketelligent.

Related:

Discover the new project

How does third-party data get from the source to the end user? Follow the exploration at the Data Market Study, also sharing discoveries and insights in a newsletter.

Sponsors