The business of monitoring, measuring and understanding social media

The Year in M&A, Social Media Analysis 2020

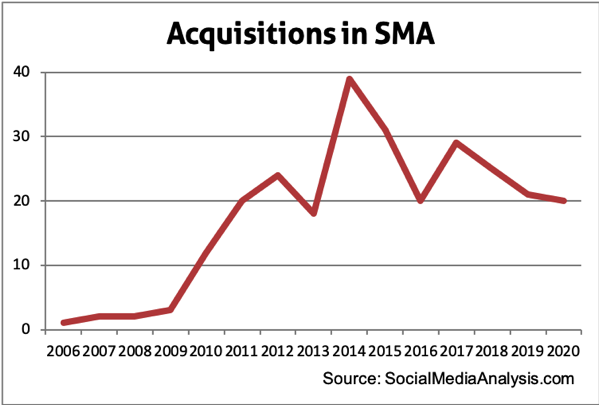

Companies in social media analysis changed ownership 20 times in 2020, only slightly off the 2019 pace. An IPO and two companies launching with acquisitions add interest to the more familiar patterns of technology acquisitions and business model combinations.

Here’s a recap of the year’s deals. As always, you can find the latest deals and a record of past deals in the space at SMA’s acquisitions scorecard.

The Rare IPO

Publicly traded companies in social media analysis have always been the exception, as even the biggest players have tended to remain privately held. Meltwater joined the list with a December IPO on the Oslo exchange (ticker: MWTR) that raised about €328 million ($399 million).

Launch by Acquisition

Aside from Meltwater’s IPO, the usual buyers from the acquisitions leaderboard were quiet in 2020. The year’s busy buyer was ASG, a buyer/operator of SaaS companies in multiple verticals. ASG launched its digital marketing portfolio, Traject, with Fanbooster and six other companies, acquired Social Report, rebranded it as Traject Social, and then merged it into Fanbooster by Traject. The company added to the portfolio with GatherUp for CX and online reviews and PLANOLY for planning, posting and measuring across social network platforms.

Across the Pacific, Isentia alumni launched Dataxet and Truescope and formed a joint venture to link the companies in Singapore and Australia. Dataxet then extended its reach to ten Asian countries when it bought Sonar Platform and NAMA.

Combining Strengths

Whether it’s billed as a merger or an acquisition, the typical deal in this market is about combining strengths, whether technical, geographic, or strategic. Combining their backgrounds in social media analysis and text analytics, NetBase and Quid merged to form NetBase Quid. InMoment bought MaritzCX to advance its vision of every-form-of-experience intelligence.

Astute added social media marketing to its portfolio and a plan to launch a unified platform with Socialbakers. Crowd Analyzer got a word-of-mouth activation platform and extended geographic reach with Task Spotting. Bazaarvoice put visual commerce in its cart with Curalate.

After working together for nine years, OBI4wan brought HowAboutYou inside to unify its commercial and public-sector businesses. W20 Group added social media analysis to its menu for healthcare clients with Symplur. Trufan expanded into player promotion and first-party data with PLAYR.gg.

AI Buys

Artificial intelligence and related technologies were essential ingredients and a reason to buy in 2020. Dassault Systèmes cited the hot topic when it picked up Proxem to enhance its 3DEXPERIENCE platform. Kenshoo got analysis that works on social media data and more with Signals Analytics.

Pieces and Assets

Last year saw more deals for parts of companies than usual. Decooda added the Service Profit Chain Institute’s journey mapping and optimization for its CX platform with CX Workout. Talkwalker bought Nielsen Social and its Nielsen Social Content Ratings as Nielsen refocused on core businesses.

ZeroFOX got an experienced threat analysis team and an extensive data source for its platform when it bought the Cyveillance business from LookingGlass Cyber Solutions. Babel Street got link-analysis technology and another product in the intellectual property assets of Dunami.

Looks Like a Duck but Isn't

The details of the arrangement with Sprinklr are fuzzy, and while it’s apparently not an acquisition, it does transfer Scup operations, customers and employees to Torabit.

If this is your first visit in a while, SMA has a new look and more content for 2021. What do you think of it?

Related:

Discover the new project

How does third-party data get from the source to the end user? Follow the exploration at the Data Market Study, also sharing discoveries and insights in a newsletter.

Sponsors