The business of monitoring, measuring and understanding social media

The Year in M&A, Social Media Analysis 2015

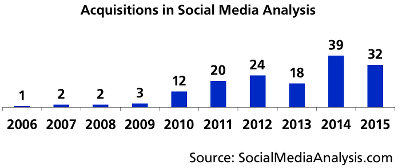

Companies in social media analysis changed ownership 32 times in 2015, down from 39 deals in 2014. The logic underlying acquisitions continues from last year, with the majority representing portfolio plays, as more companies pursue software suite strategies. The serial acquirers building large suites kept buying, while another announced plans to join their ranks. Some combinations saw smaller players in the same cities joining forces, while others represented a purchased entry into international markets.

Here's a recap of the year's deals. As always, you can find the latest deals and a record of past deals in the space at SMA's acquisitions scorecard.

Let's buy something

Almost all of the deals in this market involve privately held companies that don't reveal numbers, but the price champion of 2015 must be Cision, paying $841 million to add PR Newswire to its expanding suite of tools for PR and communications. The company also picked up Viralheat—another social media intelligence platform for a collection that already included Visible Technologies.

Sprinklr continued its acquisition streak, adding NewBrand (location-based customer intelligence), Pluck (community platforms), Get Satisfaction (customer care), and Booshaka (audience segmentation) to its product lineup, while buying entry to Brazil with Scup.

The investment firm that owns Marketwired and Sysomos separated the previously merged companies and gave Sysomos new purpose, launching a suite strategy with the addition of Expion (social media management) and gazeMetrix (image recognition).

Simply Measured bought Inside Social (conversion and attribution metrics) and DataRank (social media intelligence). Linkfluence expanded its footprint into Asia with ActSocial and Germany with Medialysten; Medialysten also gives the company traditional media coverage. Spredfast went after social data integration expertise in Shoutlet.

What's in your suite?

Beyond the serial acquirers, the suite strategy continues as a theme in most of the year's deals. Exactly what belongs in a suite depends on who is assembling it, and the different approaches on offer make it clear that "suite vs. specialist" is only part of the strategy question.

Clarabridge added real-time engagement with Engagor. Emfluence bought Spiral16 to add social media analysis to its online marketing suite. iAdvize got social media monitoring for its real-time customer engagement suite with Bringr.

Engagement Labs married Keller Fay Group to bring together online and offline word-of-mouth measurement. Insightpool linked social media for marketing and sales with Next Principles.

VICO got Infospeed's social media monitoring product while strengthening its position in German-speaking markets. Uberall bought Spotistic for its location-based social media monitoring.

Portfolio action

Some combinations look less like a suite strategy and more like themed investment portfolios. W2O Group buying VinTank, interlinkONE buying AwarenessHub, and YDM Group buying Computerlogy for their portfolios of marketing service and technology businesses. Russia's Yell taking a majority stake in YouScan. Japan's Hottolink expanding into the global market and investing in the social data supply chain with Socialgist.

Tech and talent

Other acquisition targets become ingredients in their new company's product line. IBM got a mix of deep learning and API technologies for Watson and IBM Bluemix with AlchemyAPI. Augure got a Facebook analytics tool and complementary technology and talent in Wisemetrics. ScribbleLive found influencer analytics for its content marketing platform in Appinions, while Facelift got benchmarking and analytics tech for its social media management in socialBench.

And the action in 2016 has already begun.

Update: There's nothing like posting a definitive list to uncover deals I missed. Cogia Intelligence contributed to the consolidation in DACH with its purchase of MeMo News. Ornico added social media to its brand and media intelligence portfolio with Fuseware.

Related:

Discover the new project

How does third-party data get from the source to the end user? Follow the exploration at the Data Market Study, also sharing discoveries and insights in a newsletter.

Sponsors