The business of monitoring, measuring and understanding social media

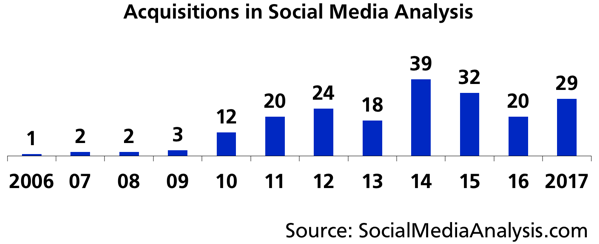

The Year in M&A, Social Media Analysis 2017

Companies in social media analysis changed ownership 29 times in 2017—up from 20 in 2016, though some unusual transactions fuzzed the count. As usual, most transactions are portfolio plays, companies adding to their technology and services capabilities. Serial acquirers were back after a break in 2016, and a customer bought the company.

Here's a recap of the year's deals. As always, you can find the latest deals and a record of past deals in the space at SMA's acquisitions scorecard. I've also written a separate post on categorizing the logic of mergers and acquisitions on my personal blog. If you like getting this kind of information, please support the effort.

Acquisition as a core competency

Several companies with a habit of buying to grow their capabilities returned to the well in 2017. Meltwater prolonged its multi-year buying spree, picking up AI technology in Wrapidity, Cosmify and Algo, plus boosting its geographic depth with Klarity (Asia) and Infomart (Canada).

Cision used a shell-company merger to go public, and then added both technology products and professional services to its portfolio with L’Argus de la Presse, CEDROM-SNi and PRIME Research. Hootsuite bought Snapchat analytics from Naritiv, marketing performance measurement in LiftMetrix and Facebook and Instagram ad management in AdEspresso.

A different kind of serial acquirer, ESW Capital, added FirstRain to its buy-and-own collection.

Consolidation

Sometimes the strategy is more of the same. In the Netherlands, OBI4wan found a media intelligence/webcare match in Buzzcapture. Repeating the pattern of a 2016 deal, Notified bought the media monitoring business of Lissly, another Swedish company refocusing its efforts.

Build vs. buy? Buy, please.

"Needing too many different tools" is a common complaint where marketing meets technology, and our companies are here to help. Sprout Social went deep on analytics with Simply Measured. Brandwatch got into content marketing and influence with BuzzSumo.

Synthesio added audience insights and engagement analytics with Social Karma and a report builder in Bunkr. Conversocial called HipMob to extend its customer engagement reach with live chat. Tickr got into competitor data with Market.Space.

Ebiquity picked Digital Balance to build its services presence in Australia. OneQube got tech and people in Them Digital while also juggling entities with Internet Media Labs.

Vertical market love

Alibaba-owned Shiji bought most of ReviewPro for its business serving hospitality clients. MarketCast picked up Fizziology to add social media to its entertainment insights and analytics toolkit. K1 Investment Management bought Actiance with a plan to merge it with Smarsh to provide compliance and information archiving in finance and government.

Offramp

Refocusing on its language technology core, SDL unloaded its oft-traded social media intelligence business to the newly-formed Social Data Intelligence (Techrigy -> Alterian -> SDL -> SDI).

Paging Mr. Kiam

Finally, American Family Insurance liked Networked Insights so much, they bought the company, which they plan to keep as an investment while tapping its expertise for internal projects. We'll put them down as a promoter, then.

I am between projects and waiting for a client decision on a major project later this quarter. Last year, I helped clients with market intelligence on location tracking for law enforcement, small cells for mobile networks, and government funding opportunities for small businesses, in addition to the social media and intelligence themes I write about. Does your company have a short-term need that I can help you meet? Reach me here and let's talk about it.

Related:

Discover the new project

How does third-party data get from the source to the end user? Follow the exploration at the Data Market Study, also sharing discoveries and insights in a newsletter.

Sponsors